This article is part of a series, in which we tend to make readers aware of the aspects regarding entering the EU market. Aware of the challenges the EU market brings, but also what opportunities entering this market brings for foreign companies. Because how does the EU market works and why should you register an entity in the EU? What consequences will the Brexit have? All these questions will be answered down below.

The system of and the rules for the EU market

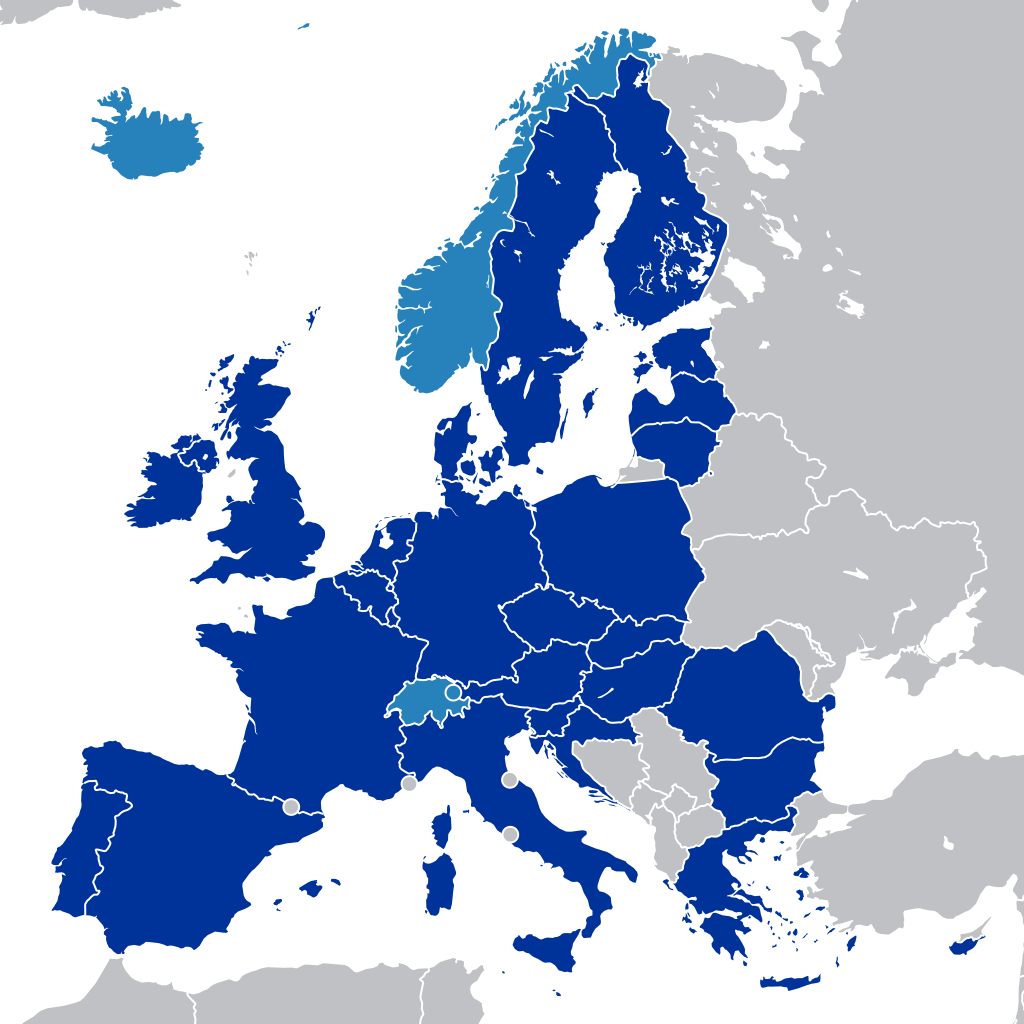

A core point of the EU market is it being a single market. This means the member states of the EU together are seen as one area, in which certain rules apply to all.

An importantly propagated point of that single market is the possibility of free trade between EU member states. That means no border controls, no trade tariffs and no extra costs when selling and distributing your products to a fellow member state.

This system makes it easier for member states to trade goods with each other, resulting in lower costs and competitive prices when buying goods in and from the EU itself as inhabitant of a member state. However, for companies and customers outside the EU this does not immediately apply. Imaginably it is a protective market that has rules for outsiders, mostly favoring the EU products instead of those abroad to stimulate the own economy. Import taxes, VAT and customs duties apply when selling to the EU.

Does that make it hard to enter the EU market? In a certain way it does, but there is a way to benefit from this cohesive market with no internal economic borders.

The single market: EU member states and non-EU states that participate with exceptions

Why should you register a company in the EU? What benefits are there in it for you?

There are multiple reasons why it is wise to register an entity in the EU. We have summed up the most important ones down below:

- Obtain an article 23 permit and make use of the reverse-charge system.

- Lower your overall (logistics costs) when selling to EU customers.

- Ease your distribution process and make it more efficient.

- Become more competitive with EU sellers.

- Get more than 508 million potential customers in the EU within closer reach.

When importing (your own) products as a registered EU entity, you will only have to deal with import costs once, after which the products are freely tradable within the EU. Making you the importer and using the reverse-charge system, you will not be required to pay Customs the VAT on your import declaration. This enables you to determine a more competitive price, since you can deduct the paid VAT as input tax on the VAT return you make for a period. Read more about this in our other article, in which you also find information about what we can do for you, how the registration works and learn about companies that have been through this process before.

By using an international distribution center you can store all products in a centralized location and afterwards distribute them to other member states. All of this will make your delivery to the customer an easier and, more importantly, more efficient process with less paperwork, faster delivery and reduced costs.

The Brexit and the EU market: consequences for British companies?

The Brexit, meaning the British Exit from the EU, will certainly have great consquences for both the EU and UK itself. It is being said that the process can take up to two years and that it is still unsure which exact outcome it will have.

Thus, at the moment of writing it is difficult to exactly determine what the consequences will be for your company specifically. However, European leaders seem to want as little benefits as possible for the UK, meaning there will be no participation in the free EU market and the introduction of trade tariffs.

When that is the case it will have a great effect on the import and export between the UK and the EU. It will become more difficult for (small) British companies to compete and sell their products on this specific market, since they will then have to deal with import tax and other costs. British products will become more expensive for customers in the EU and they might seek cheaper alternatives on the own market. All this while the current export rate of the UK to the EU is over 40%.

Will this be the future for the UK border?

It is still possible for the UK to have access to the EU market without being a member state. The EU however has a much better position in the negotiations and looking at statements of leaders this will still be a long and painful process. For example, the deal between the EU and Canada took seven years to be agreed upon.

After all, it all depends on the definitive agreement the UK will make with the EU. Nevertheless it is pretty certain that the completion of the Brexit will have its consequences. After it, companies might be better off registering an entity in the EU itself.

Conclusion

Are you interested in profiting from the benefits the EU market offer? Do you want to make sure your British company is future proof? Looking for a partner that can help you through the whole process of registration and also help you with all distribution aspects within the EU and elsewhere? Contact us and share your thoughts or request a quote immediately. We welcome you to discuss the specific needs for your business.